Chargeback Insurance for Merchants: What Is It?

Say you own a shop. It is a source of income, but it also opens the door to risks: a fire could break out, or a break-in could happen, or maybe someone will drive through your front window. If this happens, you’ll need to pay a lot of money for repairs. Another risk is a customer slipping and injuring themselves in your store, and subsequently suing for damages. Many merchants choose to protect themselves against unpredictable risks by paying a monthly or annual fee to an insurance company that will cover any losses or damages included in the policy should they occur.

Chargeback insurance is just the same, except it offers merchants who accept credit cards in a card-not-present (CNP) transaction a form of insurance against chargebacks and related fees. Card-present (in-store) transactions are protected from fraud liabilities (unless they are not up to standard on technological security requirements), but in CNP transactions it is the merchants who assume the liability to the banks.

What is a chargeback?

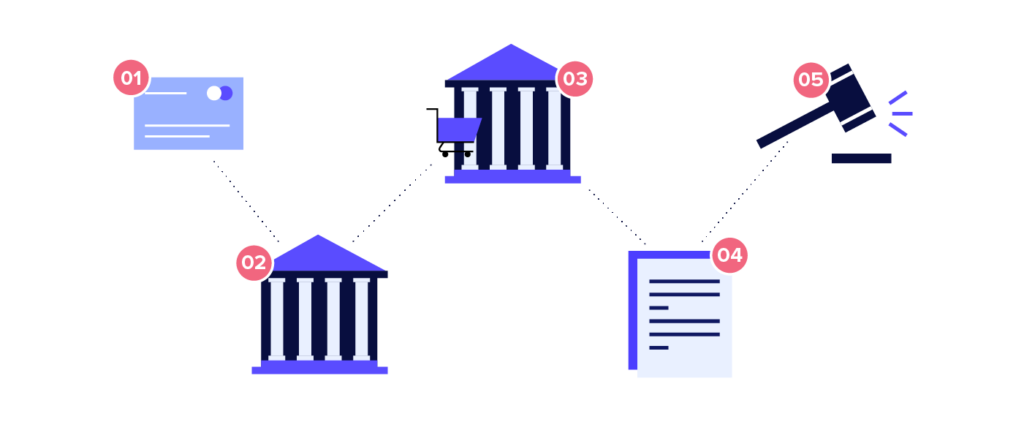

A chargeback occurs when a card owner notifies their card issuer that a transaction made to a merchant was unauthorized or otherwise problematic and requests a refund. The issuer then withdraws the money directly from the merchant’s account and returns it to the card owner’s account. This process, which does not require merchant consent due to liability, is first and foremost a consumer protection tool. However, it can be open to abuse on the side of consumers, and merchants can choose to dispute any chargebacks they receive.

How does chargeback insurance work?

Just like any other type of insurance, chargeback insurance varies greatly across service providers. Merchants should be clear on the coverage offered to them so they don’t have any unpleasant surprises further down the road.

- Chargeback insurance does not offer complete protection on all chargebacks. Most providers only offer insurance on fraud-related chargebacks, and do not cover item-not-received (INR) chargebacks or those that result from merchant error, for example. Some will not cover chargebacks related to digital goods.

- Some providers might charge a flat monthly fee, while others charge per transaction or per chargeback.

- Reimbursement also varies: Some providers will cover the cost of the “lost” merchandise or service, while others will cover the chargeback value or even the profit lost.

- Some chargeback insurance providers make the coverage contingent on the transaction being processed through specific payment processors or gateways that are known to be more established or better protected.

- Some insurance providers may place a cap on the number of chargebacks covered under the policy.

- Chargeback insurance by its own only covers the monetary side, and does not focus on prevention. It will not stop a merchant with a high chargeback rate from landing on the card networks’ excessive chargeback monitoring programs, or reduce the risk of impacted customers. Some chargeback insurance providers pair their product with a fraud prevention product.

The problem with chargeback insurance

At first glance, chargeback insurance may seem like a perfect solution for merchants wary of chargebacks. However, it’s not one-size-fits-all. Even when taking care to choose the right insurance provider in terms of both coverage and cost, it will only tackle one part of a merchant’s chargeback problem.

Furthermore, insurance as a product on its own is subject to an age-old problem: the conflict of interest. The insured merchant wants as much claims honored as possible, while the insurer wants to pay out as little as possible on a policy.

Just like a brick-and-mortar shop owner will invest in an insurance product alongside safe building materials and a fire extinguisher and suppression system, eCommerce merchants who opt for chargeback insurance should consider it as one element of their strategy for dealing with fraud, not the whole solution.

Chargeback Guarantee

Some service providers offer a form of chargeback insurance along with their fraud prevention or decision-making model. The rationale behind such a model is that since the vendor is the one making an approve or reject decision on the transaction, they should also shoulder the liability for a wrong decision. This model, first pioneered by Riskified as Chargeback Guarantee, rolls fraud protection and prevention together with chargeback insurance – though of course, the actual specifics of the policy vary between providers.