Fraud Prevention

For every type of fraud, there is a season. Gift card fraud, for example, rises around Mother’s Day, Valentine’s Day, and Christmas. Ecommerce fraud teams face a holiday hangover of chargebacks after the end-of-year gift-giving season. And policy abuse — including refund and returns, reseller, as well as promo and coupon fraud — tends to … Continued

It’s easy to understand why everybody loves gift cards, especially the digital kind. So you won’t find it surprising that the number of card purchases and payments Riskified processed from merchants in 2023 was almost double the number processed in 2021. Unfortunately, the “everybody” who loves gift cards includes fraudsters. As liquid as cash, ill-gotten … Continued

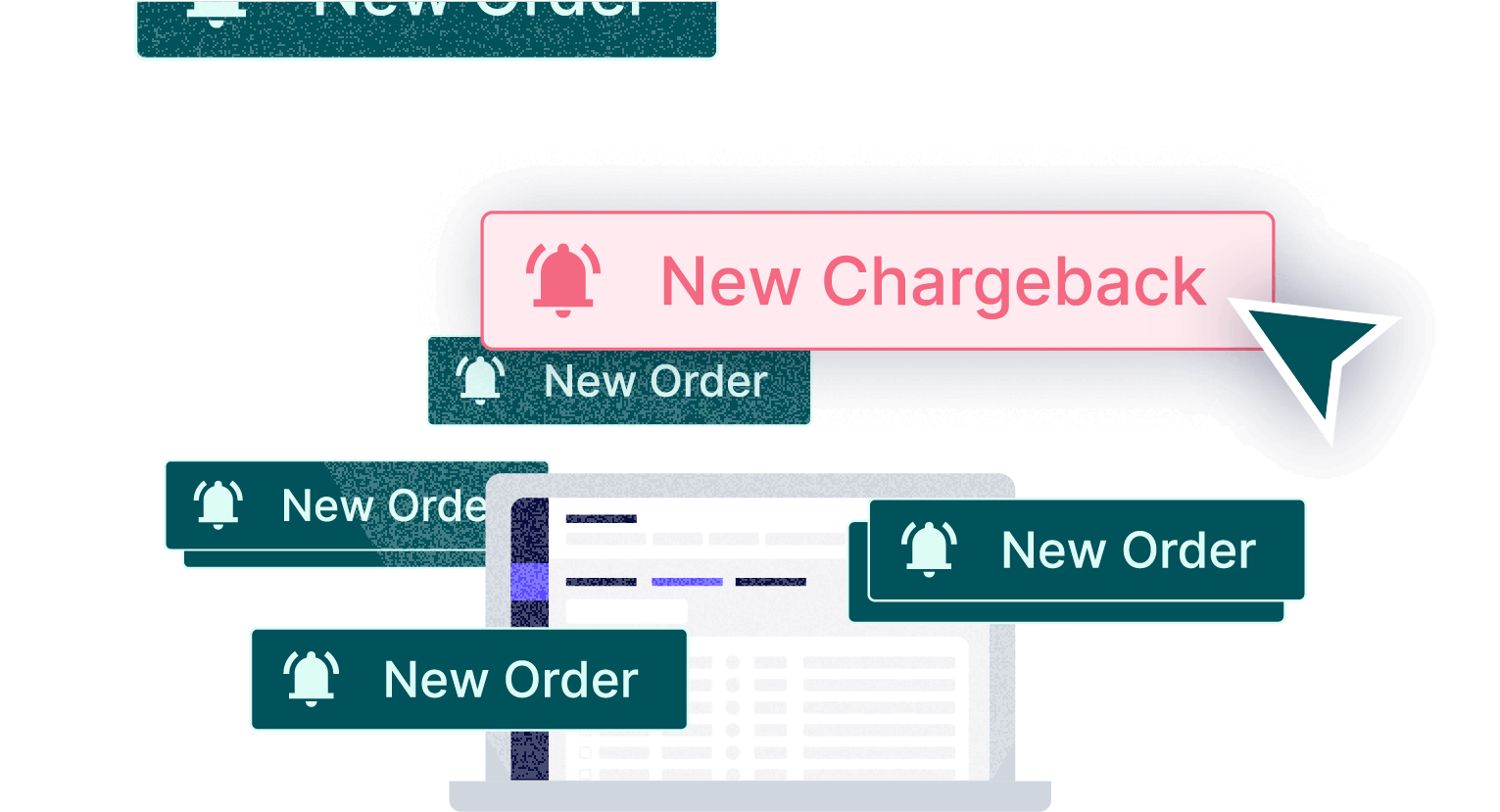

Let’s face it: Chargebacks can be an operational nightmare for ecommerce, stemming from the increasing complexity of customer shopping habits and the pandemic-related surge in online sales. Not only do you face the challenge of processing high volume, but you also deal with compiling compelling evidence from widely disparate systems — it’s an impossible situation … Continued

No online merchant will be surprised to hear chargebacks are rising. In the last year alone, more than three out of four customers in the United Kingdom and United States filed a chargeback — an all-time high. The global volume of chargebacks is expected to reach $165B in 2024. During the COVID pandemic, chargebacks became … Continued

Here’s a story about Chris, an honest consumer buying his partner a gift on your ecommerce site. Chris fills his cart and clicks to complete the purchase. Then, the unexpected happens. Chris’s card issuer refuses to authorize the transaction. Maybe Chris was shopping while on an overseas trip, the gift he chose was unusually pricy, … Continued

Fraud managers and analysts know how much work it can take to win a chargeback dispute. In addition to curating evidence, analysts spend their time manually consolidating and organizing data, divvying up work, formatting and submitting evidence, and tracking status. And when you want to track overall program performance, there’s more manual work ahead of … Continued

Across the ecommerce organization, from marketers to webmasters, the post-holiday period brings high-fives and sweet relief. Everyone gets to recover a bit after the insanity of the Q4 shopping season. Everyone except for fraud managers, that is. In the fraud prevention world, insanity season is just beginning. There’s a deluge of returns and the potential … Continued

This content was paid for and produced by Riskified in partnership with the Commercial Department of the Financial Times. Minimizing risk exposure is a core responsibility for CFOs in any organization. In ecommerce, the danger of a major fraud attack is always lurking, creating not only a constant threat of catastrophic losses, but also an … Continued

This content was paid for and produced by Riskified in partnership with the Commercial Department of the Financial Times. What is the bottom-line impact of preventing card-not-present (CNP) fraud? Even the most responsible CFO may not have an accurate answer because the true costs of fraud aren’t just a matter of tallying chargebacks. Even the … Continued