ACH vs Credit Card Is Making a Comeback in Ecommerce

What’s old always seems to become new again, even within the payment landscape. ACH, or automated clearing house, an old-school payment method you probably associate with your monthly paychecks, is having a moment in eCommerce. The National Automated Clearing House Association (NACHA) created this network in the 1970s to connect all US banks and enable electronic money transfers. While it’s only used for 1% of US eCommerce transactions, ACH is fast becoming a popular option within low margin industries. Why? Because it’s far cheaper to process than credit card transactions. So even though its volume is not as sizable as those of some other alternative payment methods, here is why some businesses should consider ACH and what they should know.

Pros & Cons of ACH

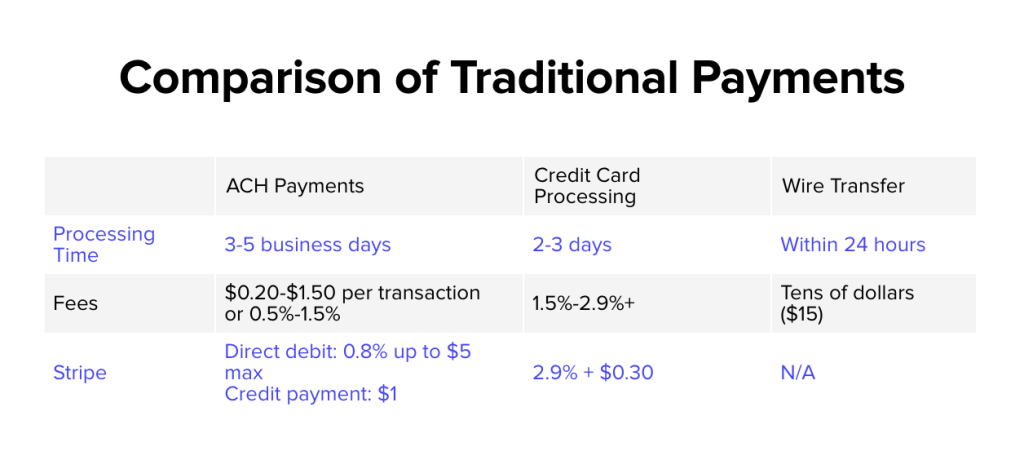

There’s a reason that ACH is the most ubiquitous payment network in the US. Credit card processing fees alone cost between 1.3% to 3.5% per transaction, while ACH transactions cost just 0.5% to 1%. Plus, ACH is considered a more secure network, experiencing lower overall rates of fraud and fewer declines compared to credit cards. Only 1-2% of ACH transactions are declined versus upwards of 15% of credit card transactions.

At this point, merchants might be wondering why they aren’t utilizing ACH. It’s important to note that ACH isn’t truly beneficial for every type of online merchant. Even though it’s less susceptible to fraud and declines, ACH payments are not guaranteed protection from fraud. This means that even a successfully completed transaction can fail down the line since ACH payments can take 3-4 business days to be processed. The payment can bounce back a few days later due to technical errors or insufficient account funds. For most merchants, this delay combined with the potential loss of revenue isn’t a risk worth taking.

ACH-friendly industries

As a result, ACH is best-suited for industries with low margins and high-cost transactions, like precious metals. These industries make less money on the products that they sell, and therefore benefit more from leveraging a cheaper payment method. A $10,000 transaction could cost the merchant nearly $350 if paid with a credit card versus as little as $50 if using ACH. Plus, customers transacting in these industries aren’t always comfortable paying with a credit card. A $10,000 transaction could max out their credit line, so some customers prefer to rely on ACH.

Another growing use case for ACH involves merchants with services like remittance, cryptocurrency, and digital wallets. Some of these merchants are leveraging their native apps to act like eWallets and most consumers will fund this wallet with ACH payments.

ACH isn’t fraud-proof

While its fraud rates are certainly lower than other forms of payment, ACH fraud still occurs. When a customer pays with ACH, there isn’t an immediate transfer of funds. At this point, only the payment details have been shared and a third-party verification service will ensure that they link to an active bank account. This is where fraud can come into play. Fraudsters can steal bank details and use ACH to make payments. They can do this without needing to change their address and name to match the bank account since the verification service is only required to check that the account exists. Merchants typically begin the fulfillment process once the account has been verified, but receiving funds through ACH can take multiple business days. Due to this lapse, it’s common for customers with insufficient funds in their account to also receive their product or service before this mistake has been realized. Verifying as many account details when the transaction first occurs can prevent these types of fraud behaviors from affecting your business.

To learn more about how you can protect your business from ACH-fraud, reach out to the team at [email protected].