Meeting Chargeback Thresholds Without Losing Customers

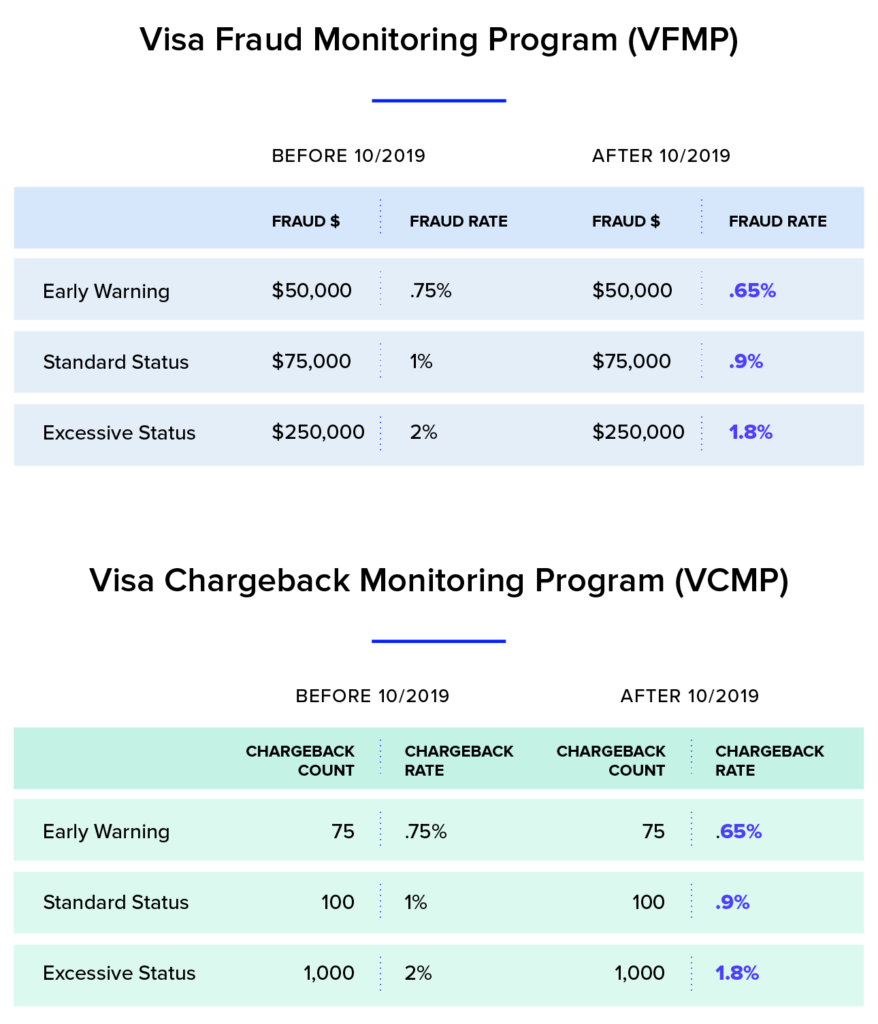

Visa and Mastercard are trending now in the ecommerce and payment world. Why? Starting this October, they both will introduce new, lower thresholds to their fraud and chargeback programs.

In this blog I’ll address the impact of this change and explain how stringent thresholds may result in reluctance to take on the risks needed to benefit from ecommerce and grow. Specifically, it may drive merchants to adopt risk-averse approaches, which in turn may curb revenue and hurt brand reputation.

What is the change?

Visa, Discover, American Express, and Mastercard are all integrated into the payment flow. They are responsible for the crediting of payments, and merchants hold financial obligations to these card networks. Merchants have to ensure that chargeback and CNP fraud levels are always kept within an acceptable threshold. This threshold is dictated by the payment networks, and if exceeded, merchants are placed into one of their monitoring programs. Once there, merchants are subject to fines and fees until chargeback or fraud rates are reduced. The most recent update from Visa, effective October 1, 2019, is aimed to protect the integrity of the payment network and keep these rates low.

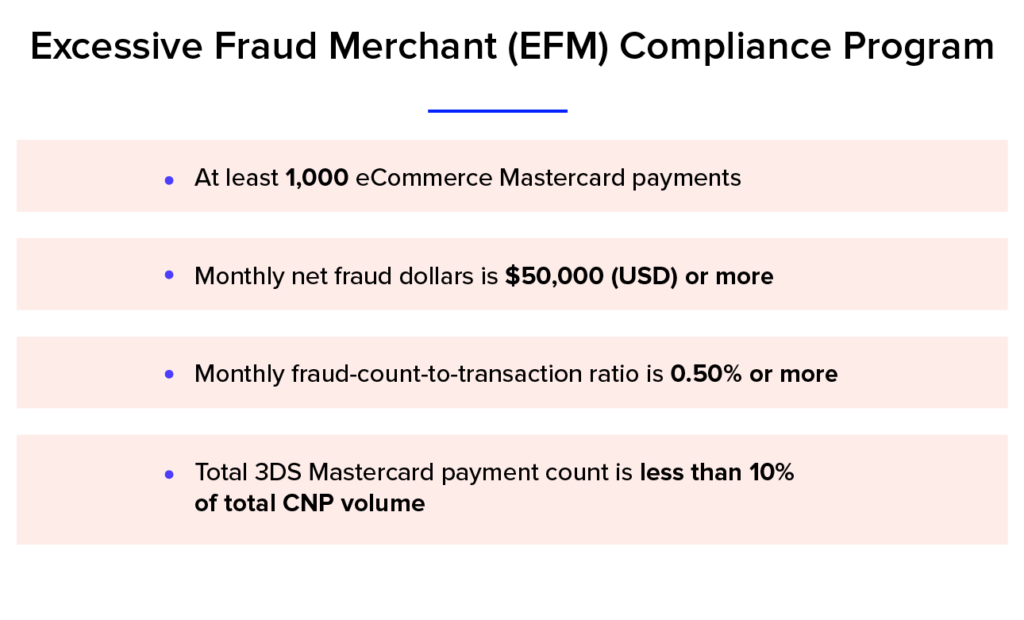

Mastercard has created an entirely new chargeback program for US based merchants, called the Excessive Fraud Merchant (EFM) Compliance Program. One of the new criteria introduced is that merchants must send at least 10% of their total CNP volume through 3DS– encouraging merchants to adopt an additional security layer on a greater percentage of their overall transactions.

The updates are aimed to lower merchants’ chargeback and fraud rates so the transactions reaching the payment networks are safer ones.

The cost of caution

Merchants will be more wary of shopping flows that carry inherent risk, like omnichannel and cross-border sales. Let’s take merchants looking to build a global ecommerce brand as an example. This transition is a natural one, with a huge opportunity for revenue growth. In Asia-Pacific alone, ecommerce revenue is expected to double to $3 Trillion by 2021. Nevertheless, as merchants tap into new markets, the fear of ending up in an excessive chargeback program may be delimiting. The result: merchants will be more likely to decline shoppers from areas with high rates of fraud, or turn away shoppers from regions they’re unfamiliar with. With 20% of all online spending expected to be cross-border by 2022, these tactics can only curb revenue growth and limit merchants from capitalizing on new markets.

For retailers who introduced Buy Online Pickup In Store [BOPIS] or similar pick-up options like automated locker systems, Visa and Mastercard’s updated monitoring program could be an unexpected constraint. As BOPIS becomes more popular with consumers, fraudsters recognize the opportunity and seize it. In fact, BOPIS fraud was up 250% the past year. But retailers should be reluctant to give up on this lucrative shopping flow that is highly coveted by shoppers. In fact, 44% of merchants believe it is necessary for competition, and 12% agree it is needed to be competitive with Amazon. So merchants are likely to take on this risk, but it may come at the cost of exercising extreme caution as they transition to safe “click and collect” sales.

An overly cautious approach by merchants can really hamper the customer experience and hurt brand reputation. If retailers add additional steps to verify order details and payment methods at the time of pickup, customers can end up waiting in long lines or having to answer lengthy questions to provide order details. You can imagine that this kind of friction can hinder the shopping experience, and the last thing merchants want is for click and collect to go from convenient to tedious.

Knowledge is power

A fraud management system needs to help merchants balance risk with a smooth customer experience. For BOPIS, comprehensive and conclusive risk assessment at the time of the online purchase, rather than when the customer is already at the physical store, is crucial. Since there is no shipping address, BOPIS orders must be treated like digital orders. Without investing in the right tools, fraudsters will be more than capable of getting away with fake credentials. Email address enrichment, coupled with behavioral analytics, IP, and device type, are all crucial in corroborating the buyer’s identity and determining legitimacy in BOPIS.

By analyzing shopping trends from multiple geographies, merchants can safely expand to global markets without worrying about the risk. An extensive order history from a target geography can help account for local shopping habits, which in turn will help better vet orders from the said geography. For example, writing in caps lock is normally considered a risk indicator, but in France this behavior is standard and seen across good transactions from that region. Localized data can help merchants safely grow their foreign customer base without rejecting good shoppers along the way.

Risk is always going to be a factor in ecommerce, but with accurate fraud prevention, even updated fraud thresholds do not have to make matters worse. Learn more about how Riskified can help your business approve more orders, no matter the changes ahead.