Chargeback Disputes with AI

As a result of the pandemic, and the ensuing economic slowdown, customers want money back for things they feel they no longer need, which puts many businesses in a precarious position.

As businesses shutter their doors due to the COVID-19 pandemic, consumers across the globe are staying indoors and focusing on essentials. People are turning to eCommerce for food, home improvement supplies and gym equipment, which puts strain on fulfillment resources that are already limited. At the same time, non-essentials, such as clothing and accessories, are seeing spikes in cancellations. Customers want money back for things they feel they no longer need, which puts many businesses in a precarious position.

Chargeback abuse negatively impacts revenue streams and financial planning for the merchant. But if the merchant tries to overturn the chargeback because they believe the customer is a liar-buyer, this can seriously taint their brand reputation and the loyalty of the customer they might be wrongly accusing. With 83% of merchants seeing at least 10% increase in friendly fraud YoY, how can they discern if their cancellation policies are being abused?

What is Chargeback Abuse?

This is when an individual takes advantage of the chargeback process to get a refund, typically claiming that they weren’t the one who made the purchase. They dispute the purchase despite having authorized and received it. What prompts someone to do this? Sometimes it’s a parent claiming on behalf of a child that used their credit card to buy Fortnite credits online without their permission. Other times it can be buyer’s remorse when the customer realizes they don’t really need that $3,000 bag. In times of uncertainty, it’s often people intentionally exploiting the system. This could mean an airline customer going directly to their credit card issuer to get a refund rather than through the airline itself for a flight they no longer wish to take.

This is a common problem for merchants regardless of the circumstance – cardholders bypass them and go directly to their issuer in 76% of fraud-dispute cases. Handling a fraud dispute directly can be easier for a merchant because they can stop chargebacks from ever being filed. But for consumers, filing chargebacks can be routine. According to Javelin, 45% of consumers report that they have disputed at least one transaction in the past year, and 25% have disputed more than one.

Merchants need to stay on top of this problem before it gets out of hand. If a merchant receives too many chargebacks they risk being enrolled in an excessive chargeback program that may result in high fees. For example, if merchants have a chargeback rate of over 0.9%, Visa will start charging $50 per chargeback after 4 months. Even if the merchant disputes the chargeback successfully, there are still fees involved that can set their business back. Whether it’s successful or not, high chargeback volume can create unfavorable relationships between merchants and credit card companies, so what can merchants do?

Effective Chargeback Management

Having a strong chargeback management strategy is the first defense in protecting revenue and maintaining brand reputation. There are two main components of effective chargeback management: Prevention and Representment.

Prevention

Merchants want to prevent chargebacks from happening at all because this preempts high chargeback rates and the resulting fees that negatively affect revenue streams. It also upholds a better relationship with the customer – 63% of consumers with disputes report that they are more cautious about patronizing merchants similar to the one where the fraud-dispute occurred. Avoiding chargebacks altogether can prevent these issues and more.

In order to prevent high chargeback rates, merchants should ensure that their customer care team is well trained and staffed. According to Javelin, in more than 8 in 10 cases, no chargeback will occur if the customer first contacts the merchant, so customer support should be ready and able to resolve any issues that arise. Along those same lines, refund policies should be clear and easy for customers to follow. They should also be readily available on the merchant’s website, in communications with customers and during checkout. Billing descriptors should also be recognizable on a customer’s credit card statement, otherwise they may wrongly file a chargeback if something looks amiss.

Aside from implementing best practices to help customers, merchants should also be proactive internally. Chargeback management teams should be fully versed on the authorization process so they can work more seamlessly with issuing banks. Leverage delivery confirmation, like asking customers to sign for a package, if chargeback abuse is a larger concern. Fraud management also needs to be quick and agile to catch bad actors before orders are completed.

Representment

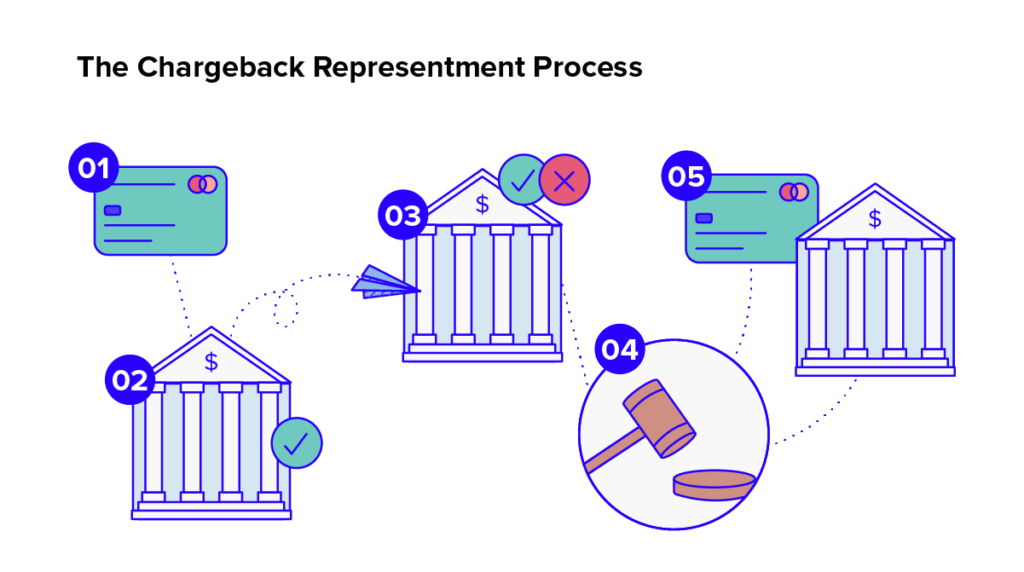

Prevention practices don’t always work. When prevention fails, you want to be prepared. If you believe a chargeback claim is abuse, representment can help you dispute the charge. There are several steps involved in filing a dispute, so understanding the process is key.

Step 1: Card-holder files a chargeback

Step 2: The issuing bank reviews the claim and if it’s determined to be valid, it will be sent to the acquiring bank

Step 3: The acquirer reviews the chargeback. If they deem it to be invalid, they will decline it and inform the issuing bank. If they deem it to be valid, they will inform the merchant.

Step 4: The merchant reviews the chargeback and either accepts the chargeback or files a dispute supported with compelling evidence.

Step 5: If the evidence is deemed compelling, then the issuing bank rejects the claim and the customer is charged. If the evidence is not compelling, then the credit will be taken from the acquiring bank.

Representment occurs during step 4 when the merchant needs to support their dispute with compelling evidence.

What is Compelling Evidence?

To make the best case during a dispute, merchants will want as much information possible that proves that the buyer is commiting chargeback abuse. Address matches, social media accounts, positive payment results, phone matches, email matches, IP connections, browsing data, customer communication and proof of delivery would all make for strong compelling evidence that the customer actually made the purchase. Gathering this evidence will be highly resource intensive because not all of it can be easily collected. It could take a lot of manual work to scour the internet for social media accounts, retrieve proof of delivery and compile related customer communication. Not to mention that verifying IP connections and incorporating browsing data is out of most internal team’s purview.

Automated chargeback representment services can better compile this evidence. They typically have extensive order history data that can help identify chargebacks that are likely to win in a dispute. Machine learning can detect this by gathering data like IP address, device fingerprinting, behavioral analytics, and more, and then cross-referencing this data across past orders in the merchant networks. If the customer claims this order was fraudulent, but the system can, for instance, verify that it was placed using the same IP address and device where the shopper has placed orders in the past, then it’s more likely that this customer is a liar-buyer.

How Riskified Can Help

The dispute process is resource intensive. Merchants consider assessing the relative value of fighting a chargeback among the top challenges in dealing with fraud-related charges. Riskified’s representment models are geared to manage this process at scale. We can predict which chargebacks are good candidates for representment automatically instead of manually reviewing them or challenging everything. Through our extensive merchant network and elastic linking technology, Riskified can flag customers that we’ve successfully represented a chargeback from in the past. When we see them making a similar claim at another merchant, we already have strong evidence to label them as a dispute candidate once more. By automatically identifying candidates for disputes and gathering compelling evidence, we can save merchants’ teams time and headaches. As more customers abuse the chargeback process during these times of uncertainty, having a trusted partner to keep your revenue strong and your chargeback rate low is more important than ever. Plus, integration is quick and easy. Stop paying liar-buyer chargebacks, and using up your team’s valuable time.