Growth Forecasts, Customer Acquisition, and the “Faux” Account Problem

You’re a merchant publishing your quarterly or annual financial statements, and you’ve had a great season. Your marketing investments have paid off, resulting in an influx of new customers. These first-time customers are a major growth engine. They’re also a significant factor in the equation businesses use to calculate their growth and revenue forecasts. A steady stream of new customers often translates into stock market success, leading analysts to mark your business as one to bet on.

So far, so good? Well, it’s complicated. Because sometimes, as PayPal recently found out, these new customers are not new at all.

The growth forecast dilemma

In February, PayPal announced it had closed 4.5 million user accounts and slashed its new customer forecast for 2022 from 53 million accounts to 15-20 million. The company also stated it’s abandoning its goal of reaching 750 million active users by 2025, first reported in early 2021. Instead, Paypal said it will now focus more on increasing the revenue potential of its existing user base. The market responded by crashing the company’s stock by 25%, its highest drop on record.

What happened? In its announcement, PayPal cited “bad actors”—more specifically, users who took advantage of its incentive and reward programs, opened multiple accounts and, presumably, misled the company about its actual customer acquisition figures.

Multiple account abuse takes many forms. Some target loyalty points and coupons, others promo and referral bonuses, and more deviant abusers might aim to hide shady activity such as INR (item-not-received) abuse or unauthorized reselling. The result is the same, though: Merchants believe they have acquired multiple accounts, each with its own customer lifetime value, while in fact, multiple accounts share the total CLV of only one shopper. In other words, merchants are flying blind.

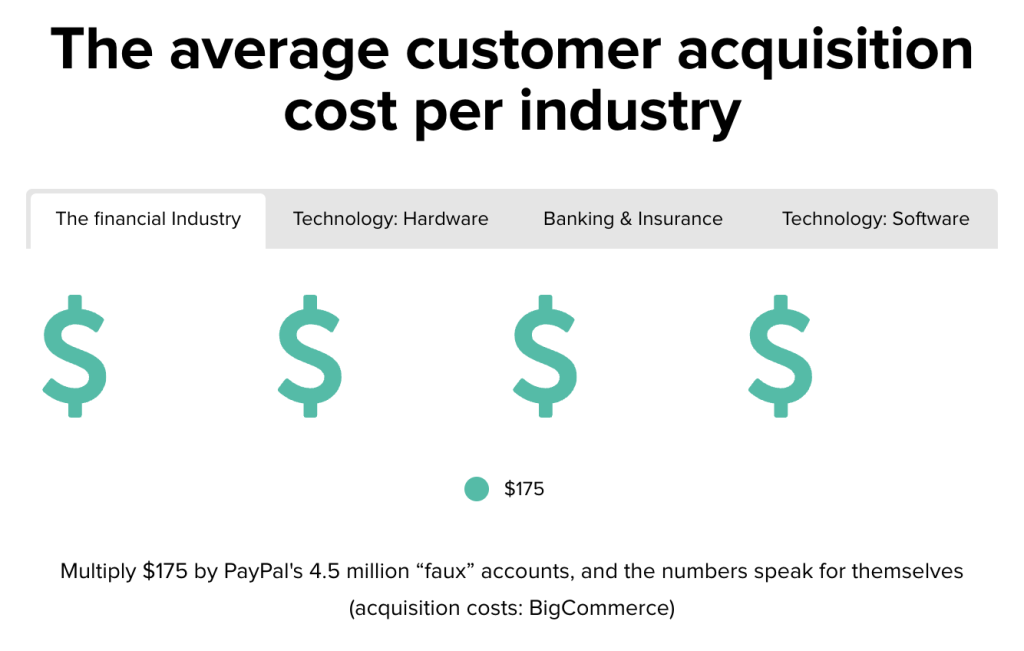

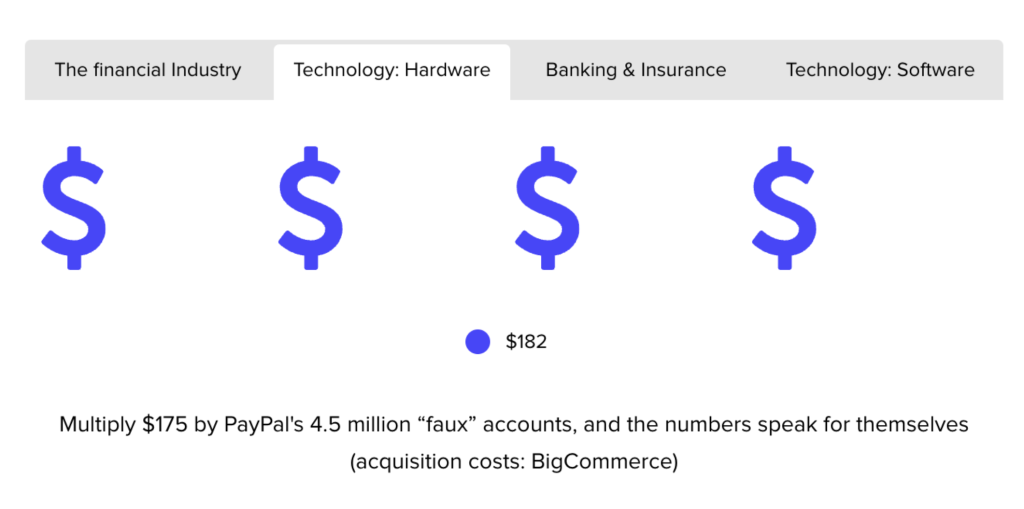

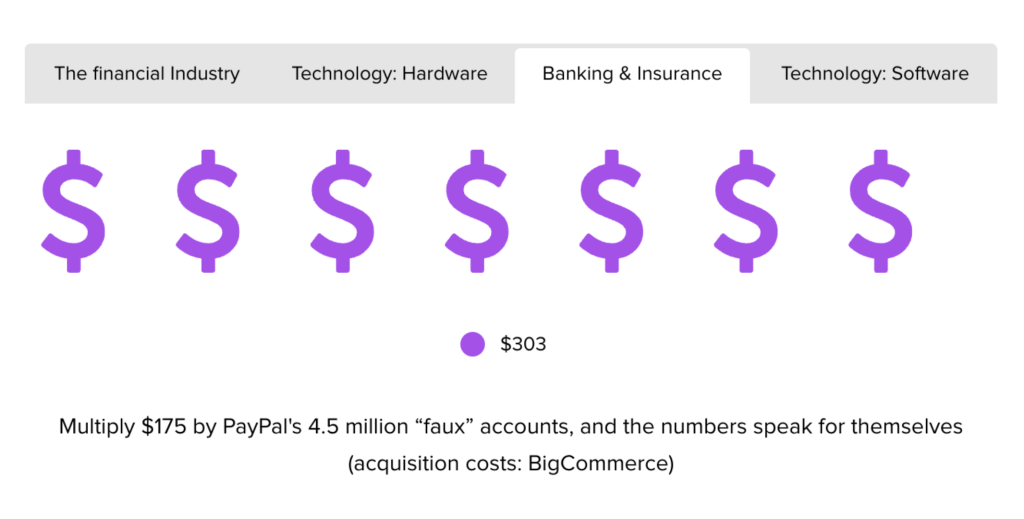

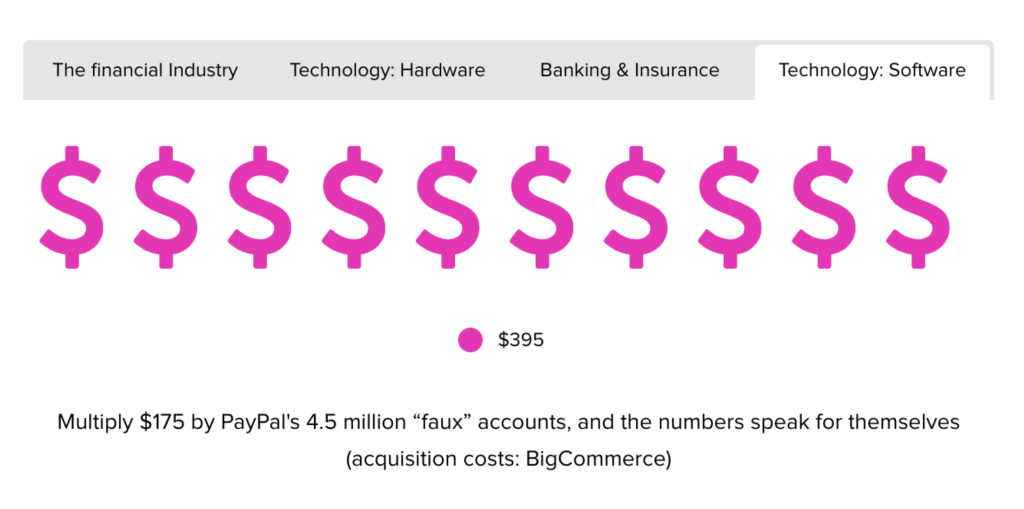

Think of it as going on a lengthy road trip with no idea how much gas is actually in your tank. How can you plan a roadmap or milestones if you don’t have an accurate measure of the resources at your disposal? Accounts with no actual CLV mean merchants are losing twice: once on the marketing and acquisition costs that went down the drain, and once on the anticipated revenue that will not be coming in. Even worse, merchants are left facing a dilemma: How can they even forecast growth and revenue accurately, if they can’t tell their fake customers from their real ones?

The science of identity-based customer acquisition

So you know you have a problem with multiple account creation, and understand that to factor the CLV of new accounts into your growth plans you need to ascertain they are real. For this, merchants need to take an identity-centered approach. To sum up a complex issue in four words: count identities, not accounts.

When policy abusers open multiple accounts to commit promo abuse or self-referral, they do so using new details: a new email address, a new credit card, a new name. Most merchants lack the technology and the database to look beyond these surface details and realize multiple account IDs belong to a single individual. As such, they have no way of knowing from the get-go the secret history of a seemingly new customer.

Information sharing is one way to combat this. Riskified, for example, already knows up to 90% of the first-time customers of its merchants, thanks to seeing them shop previously with other merchants on our vast cross-industry network. Belonging to such networks or partnering with other merchants can help fill in customer data gaps.

But even vast data, on its own, it’s not enough. Riskified’s identity-based clustering technology builds on that data with capabilities such as shopping data enrichment tools; graph technology for representing and visualizing connections; and machine learning technology that drives sophisticated decisioning and identifies connections. This enables us not just to connect seemingly unique identities to a single individual but also to know when multiple unique users who buy from the same IP—for example, a dorm or an office—are indeed unique and should be treated accordingly to avoid insult.

The bottom line

Only by looking beyond surface identities to the actual consumer behind them can merchants gain the confidence to acquire new customers safely, know they are who they say they are, and make accurate long-term plans. To learn more about how Riskified helps merchants reward loyalty while preventing abusers from gaming the system, click here or reach out to us at [email protected].