The Japanese Midyear Holiday Season

For international merchants expanding into new markets, it’s important to get to know local cultural and shopping habits. We put together these insights on a uniquely Japanese tradition - the summer holiday gifting season - for retailers selling in and to Japan.

The Opportunity

Summer is a season of increased spending across Japan, as people exchange Ochugen gifts. Riskified data shows a sharp increase in eCommerce transactions beginning on July 1st and continuing throughout the summer. This is a unique global phenomenon; In 2020, across most of the globe, the biggest sales spikes outside of the winter holiday season occurred in April and May. In Japan however, summer sales topped spring volumes, with 33% more transactions than the monthly average for that year. During the holiday of Obon in mid-August, order levels increased an additional 14% compared to the rest of the month.

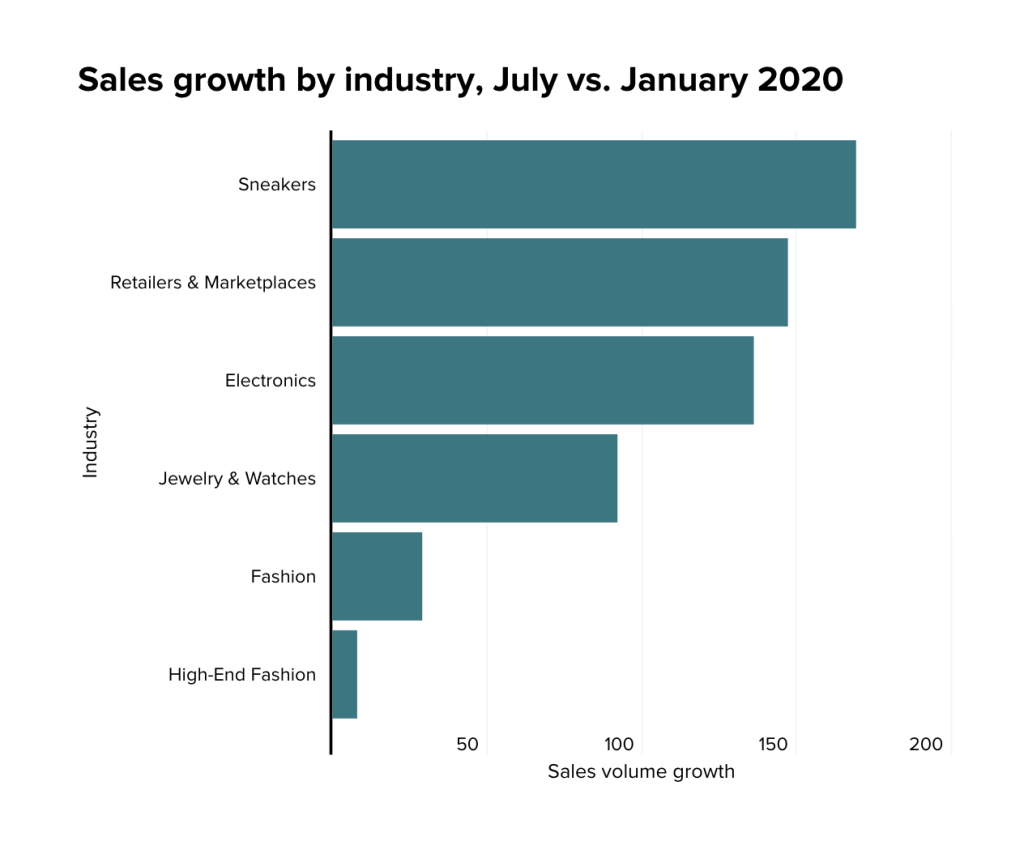

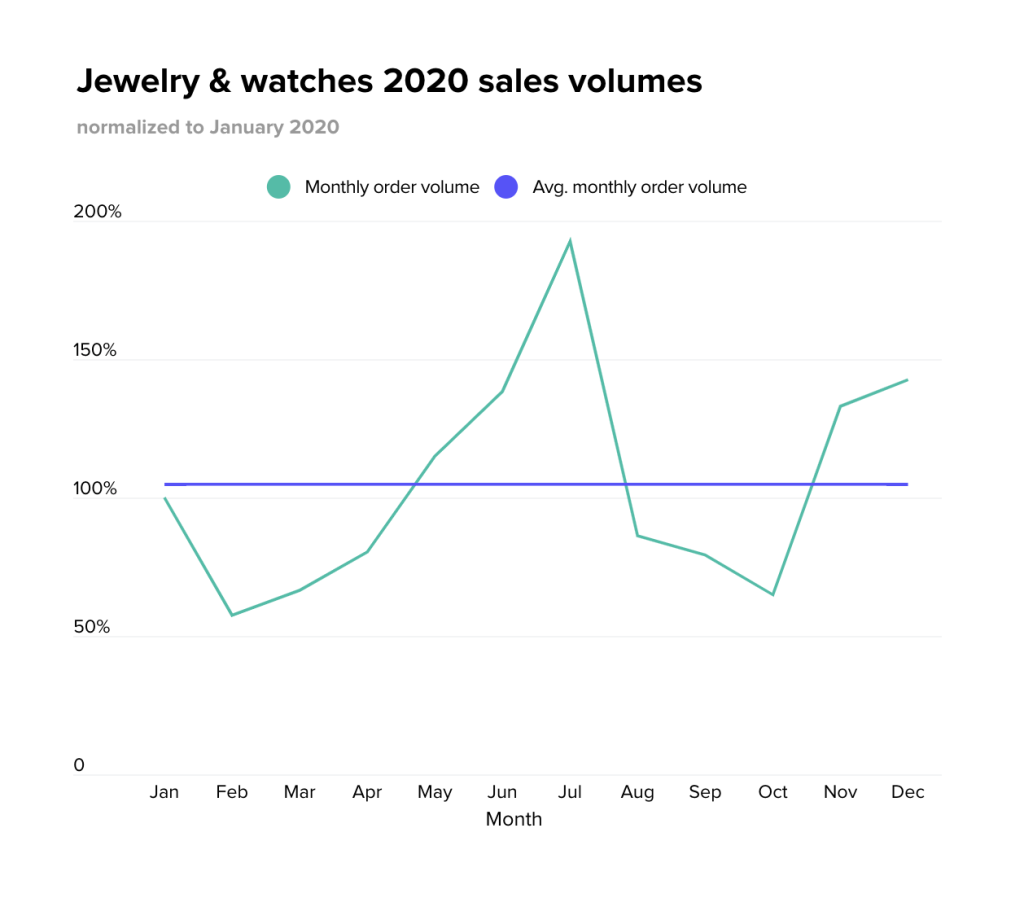

While traditional Ochugen gifts may focus around local goods, food items, and confectioneries, the summer holiday season is also an opportunity for retailers to offer discounts and incentivize spending. Online, the industries which experienced the biggest sales boom in July 2020 included sneakers, retail marketplaces, and electronics (up +169%, +147% & +136% respectively compared to Jan 2020). For the jewelry and watches segment, July was the month with the highest sales volume, at 92% more than January – higher even than the winter holiday season.

The Risk

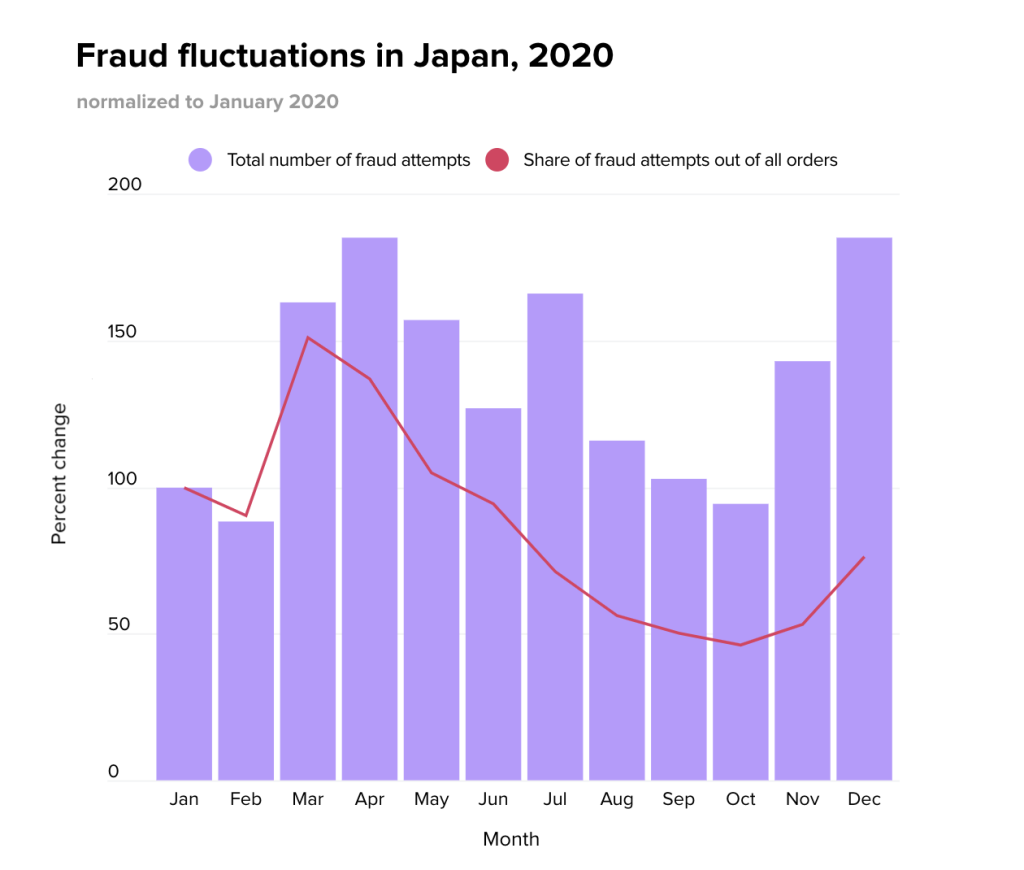

At Riskified, we’re long familiar with fraudsters’ habit of imitating customer behavioral trends in order to appear legitimate and bypass fraud screening. Therefore, when there’s a sales boom, it’s usually followed by an increase in the net number of fraud attempts. However, thanks to the massive influx in good shoppers, the proportion of fraud attempts compared to legitimate transactions is actually smaller than average. This is what happened in July: the net number of fraud attempts was 66% higher than in January, but their share out of all transactions dropped by close to 30%.

Fear of fraud is one of the major factors that stunt merchant growth and expansion. Merchants use various methods to ensure a low chargeback rate – but often those are legacy solutions that rely on outdated or unsophisticated rules that cannot respond to a quickly changing market with enough flexibility. The end result is that merchants turn down good customers – meaning that not only is their approval rate lower than it could be, but those customers that have been turned down are not coming back for a second try – and that really impacts long-term growth and profitability as well. Those solutions also introduce friction into the customer journey that leads to high dropoff rates, even before those potential customers reach the approval stage.

The Bottom Line

Removing barriers for non-domestic shoppers can be a huge engine for growth. Many merchants, however, remain wary of expansion, fearing unfamiliar eCommerce cultures and unknown fraud risks. The influx in volume during Japan’s summer holiday season, for example, can put a strain on operations. In today’s rapidly changing eCommerce landscape, merchants need an adaptable and automated fraud prevention solution, capable of processing new information and approving more good deals.