Nothing Is the Same: Key Trends Impacting the Travel Industry

The COVID-19 economy led to major changes in consumer shopping habits. The last few months saw shoppers switch brands, adopt different fulfillment methods, go mobile, and much more. While the impact to each eCommerce sector varies, they all have this in common: customers are exhibiting new and atypical shopping behaviors.

As the global travel industry starts showing signs of reawakening, travel merchants will need to adapt quickly in order to take a big step forward. In this blog, I’ll walk through some of the latest travel trends we’ve seen, and what travel merchants can do to foster a safe restart.

Understanding the latest trends and what we can learn from them

The inability to plan ahead has been, perhaps, the greatest influence on travelers’ buying habits. This could be the reason why one-way tickets are recovering faster than roundtrip orders. Initially, this trend was attributed to customers wanting to travel back home; roundtrip tickets were down by close to 70% as soon as lockdowns and restrictions were being enforced. Now, with no guarantee on what the next few months or even weeks will hold, customers are still focusing on the short-term planning of a departure date. It comes as no surprise that people are booking more last-minute trips, traditionally considered high-risk transactions.

From June to August, air travel booked 2-14 days in advance saw the largest increase in volume, while orders in the 30-60 day segment dropped significantly. This is a perfect example of a risk-indicator becoming the norm among good customers, and it makes fraud identification trickier. Merchants know that it’s a critical time to establish customer loyalty, and a falsely declined transaction could send a lucrative customer straight to the competitor. This is why it is crucial that merchants contextualize travel orders with broader industry trends in order to accurately benchmark risk. For example, legitimate customers are not only purchasing last-minute, one-way tickets, but they are opting for shorter stays and domestic travel.

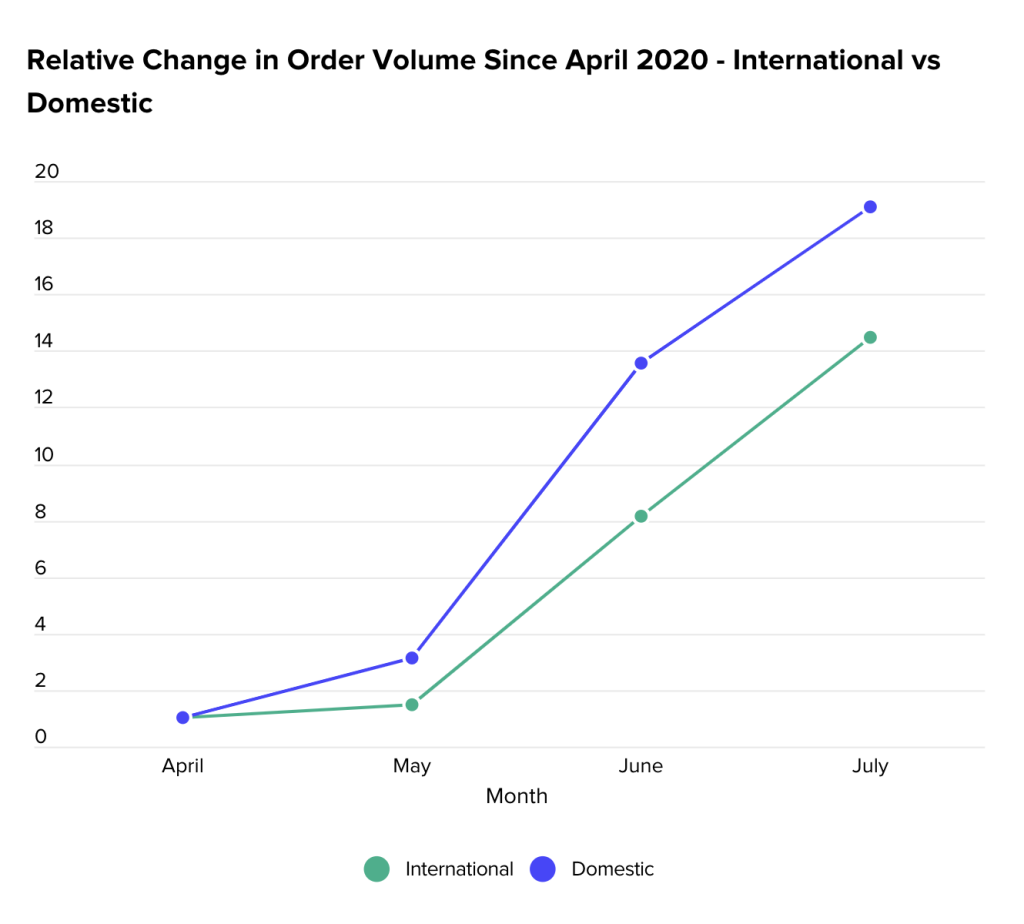

Our data reveals that over the summer months, domestic travel recovered at a faster pace than international travel.

In line with this, in July, American Airlines’ senior vice president of network strategy told the New York Times that the company was seeing a “slow but steady rise in domestic demand” and had built its July schedule to match the trend. The carrier promptly boosted its service to trending spots like Florida, Colorado and Wyoming, as Americans became eager to travel after sheltering at home for months. Our data indicates that short-term travel recovery rates in North America are 3 times higher than long-term. In this region, trips of 1-3 days grew significantly compared to 4-7 days and more than 7 days.

With this in mind, what are some red flags that merchants should look out for? Roundtrip flights pose a new opportunity for fraudsters who know that fraud systems operating by pre-COVID standards treat them as safer. Merchants should also pay attention to domestic vs international tickets. As most legitimate customers are staying local and booking domestic travel, fraudsters may go after this segment and hide among the influx of orders. Beyond modifying risk thresholds to account for changes in shopping patterns, merchants should be carefully monitoring account login activity. Fraudsters break into accounts because they know that merchants are eager not to disappoint their loyal customers. But with more lax policies along with fear of adding any unnecessary friction, airlines are handing fraudsters a golden opportunity for successful account takeovers.

The perfect ATO

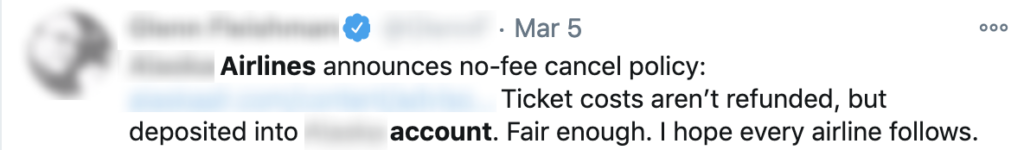

During this critical time, many airlines have recently made their cancellation policies much more flexible in order to foster loyalty for when customers are ready to travel again. So travelers are now able to get their money or miles back without paying fees to re-deposit them if they cancel their flight.

For fraudsters, it couldn’t be a better time to go after these accounts. Here’s how it works:

- Customer’s accounts are hacked

- The fraudster books a flight using stored payment or with points/miles

- After the order is approved, they cancel it, and ask for a refund

- Now the fraudster has a stolen account with credit in it and they can sell the account for a much higher price on the dark web

Loyalty accounts usually go for $5-10, but an account with a pre-approved flight that can be redeemed with no further verification, could be resold for $100 or more. The fraudster in this case is able to make an extra $90 without having to commit any additional hack. Why are these kinds of ATOs so successful? One reason is that they’re hard to spot. These attacks are lucrative for fraudsters, who bank on the victim’s existing relationship with the merchant, including a history of good orders, to help them bypass stringent fraud prevention measures. So what can merchants do? The answer lies in accurate login decisioning. Merchants should leverage data points like IP, proxy use, behavioral analytics, and bot detection to fill in the gaps in information and make a reliable decision at the login point.

Conclusion

There is no doubt that flying right now is no small feat for merchants and for travelers. That said, by ensuring a seamless and safe checkout experience, airlines stand to gain new lifetime customers. With shopping patterns and fraud MOs changing faster than ever, the trick is partnering with a solution that can keep up with dynamic trends in order to accurately discern safe transactions from risky ones.