Protecting Your eCommerce Revenue During The Coronavirus Pandemic

Earlier this month, the World Health Organization officially declared Coronavirus a worldwide pandemic – and seemingly sent everything into hiatus. Seemingly, that is, because with nearly 3 billion people around the globe under COVID-19 lockdowns, many are turning to online shopping to fill their basic needs.

A few months ago, we could have said consumer behavior evolves and changes in accordance with technological innovation. What we’re seeing in our data today, however, is a rapid disruption in buying patterns. These include a spike in new online shoppers, more mobile app use, and fluctuating cart values and velocity, which we’ll discuss in the following sections.

Some of the behaviors consumers are adopting are consistent with what is often perceived as fraud. So algorithms that are based on “regular” (non-pandemic) patterns might mistake current shopper behavior for fraud, leading to a rise in false declines at a time where every order counts.

While some industries are experiencing a decrease in the number of fraud attempts, fraudsters, it seems, remain mostly undeterred by the pandemic. The need to distinguish friend from foe is as important as ever during this economic turbulence. The risk of falsely declining good customers – and leaving revenue on the table – is a threat to merchants’ ability to weather the storm. However, merchants can minimize fallout by analyzing current trends in consumer behavior:

A spike in new customers

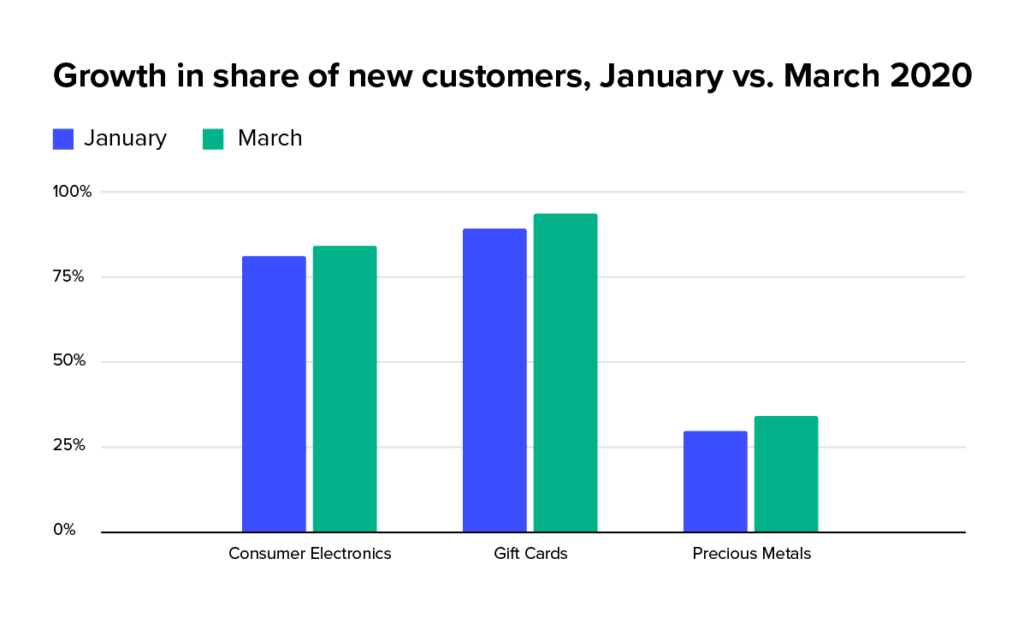

With more people confined to their homes and turning to eCommerce to fulfill their needs, many merchants are seeing an increase in new customers. We’ve seen evidence of this growth since the beginning of 2020 in industries such as consumer electronics, gift cards, precious metals, and furniture, to name a few. This room for growth is crucial for business, especially during unstable times.

New customers, however, pose a higher risk of fraud for merchants. Returning customers are generally a safer segment, particularly if they have habitual buying patterns. On average, orders made by new customers appear to be 3x as risky, though this varies between industries.

Rather than challenging all orders from newcomers, merchants should focus on maintaining the highest possible approval rate for this segment. Not only do they have an immediate impact on revenue, they can also become returning customers, both during the pandemic and after it.

More mobile app transactions

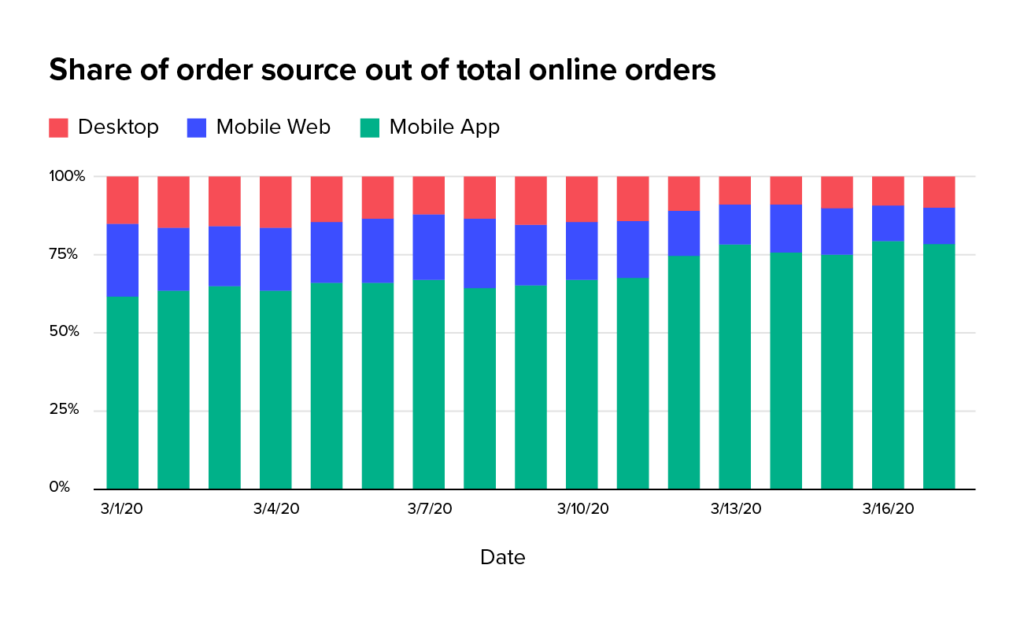

Since the beginning of March 2020, we’ve been seeing an increase in orders coming from mobile apps, at the expense of desktop and mobile web orders. One explanation for this is that people in isolation are spending more time on their phones, interacting with their loved ones. Subsequently, these have become the go-to device for many other daily tasks.

The share of mobile app orders grew by almost 30% in just over two weeks, and now makes up 4 out of every 5 online purchases. Interesting to note is that the tipping point seems to have been March 12, the day after WHO officially declared Coronavirus to be a global pandemic – and the moment when many people decided, or were ordered to stay home.

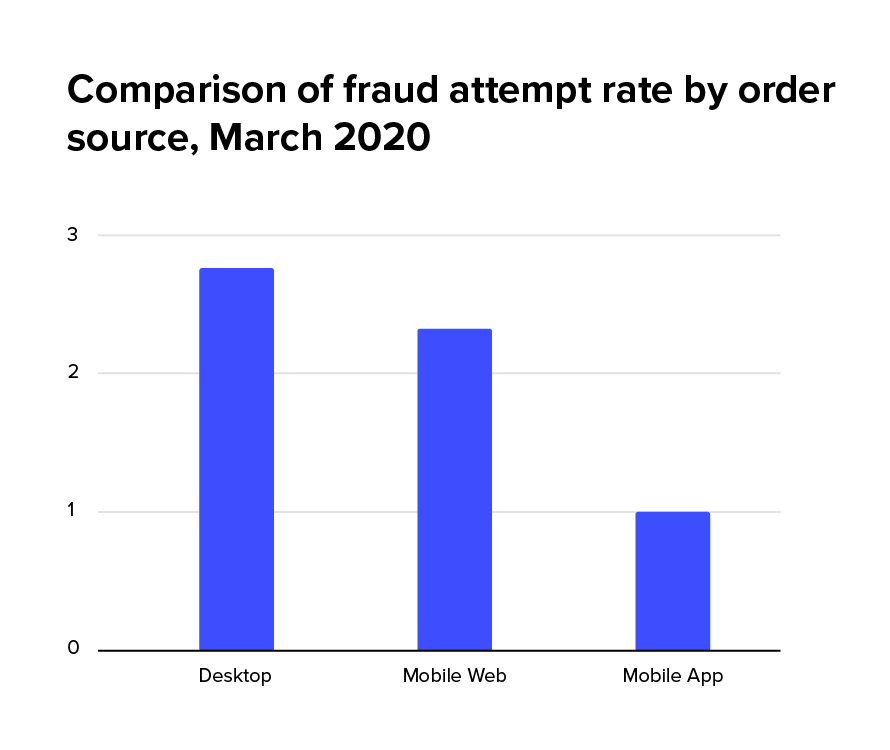

Mobile app orders, while gaining in popularity for the past few years, are often perceived as risky. As honest customers shift to mobile apps, fraudsters trying to emulate them are doing the same. Moreover, mobile apps pose an increased risk for ATO (account takeover) attacks, as many of them encourage account creation and storing payment methods, making them a lucrative target for fraudsters. However, our data shows that globally, mobile apps are currently the safest segment, with a fraud attempt rate just over one third that of desktop orders. The graph below shows comparative fraud attempt rates per order source across all industries and geographies during March:

Changing average cart value & velocity

Every industry is impacted by this pandemic in a different way. Some industries, namely anything essential for extended lockdown periods, are seeing an uptick both in the number of orders and in the average value of each order. In the home accessories industry, for example, we’re seeing order values 13% higher than the same period last year. Precious metals are up a whopping 120% – this is common “crisis behavior”, as fear of market turmoil motivates some to invest in solid assets like gold or silver.

While bigger transactions are a good thing for merchants, irregularly high cart values are often perceived as a risk indicator. Fraudsters generally target higher-value goods, as they’re spending someone else’s dime. Merchants should, however, be careful of mistakenly declining good customers who are simply stocking up.

Changes in the overall velocity of orders are also having an impact. Merchants seeing an influx of orders have to meet customer demand while dealing with understaffed fraud prevention teams. On the other hand, for industries experiencing a decrease in volume, there is more pressure to capture every good order.

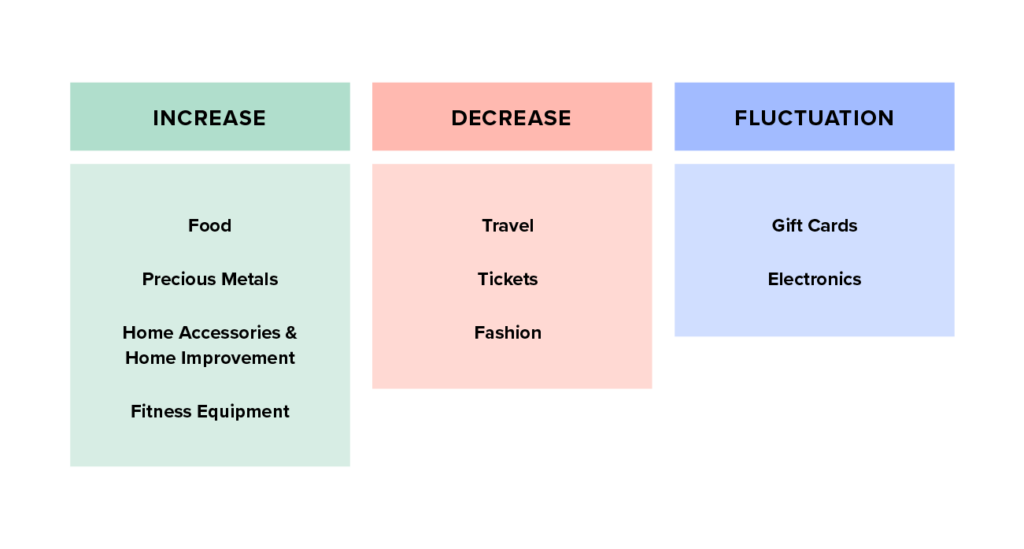

Since the beginning of March, we’ve noticed velocity changes in the following industries:

Necessities such as food are seeing growth of up to 70% compared to the beginning of March. On the other hand, industries such as event tickets, which are in low demand during the extended lockdown, have dwindled to just a tenth the number of orders. For industries like gift cards and electronics, the daily number of orders fluctuates by up to 40% and 20%, respectively, with each spike or dip in sales lasting anywhere from one to five days. For those merchants experiencing fluctuations, each order spike can look deceptively like a fraud ring. Manual review teams will be stretched to handle these spikes, and rigid rules-based systems run the risk of high false decline rates. These merchants have to be particularly adaptive to be able to handle the inconsistent volume.

Key takeaways

The times, they are a-changin’: we don’t know how long this pandemic is going to be with us, and we don’t know how hard it’s going to hit global economies. What merchants can do is to try to understand evolving customer behavior and adapt as changes occur. This approach will help merchants better position themselves to mitigate the fallout. Specifically, we talked about minimizing false declines by recognizing new patterns in consumer behavior. Some key takeaways:

- Provide as many digital channels so that shoppers can find you, wherever is convenient for them. In particular, merchants should focus on optimizing mobile apps. If possible, offer rewards or discounts for app users. Run ads that push people to download and engage with apps. They’re already spending more time there.

- Help new customers make the leap. Merchants need to make sure their order flow is as simple as possible, so that consumers less familiar with eCommerce can make the transition with ease. Educational materials can help achieve this.

- Continue to meet your customers, wherever they’re going. As the pandemic wears on, these trends too could change, and merchants should keep their ears to the ground to be able to pivot in real time.